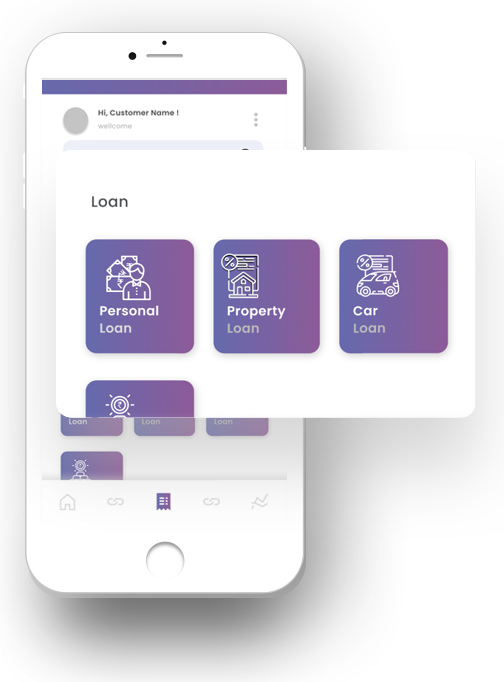

Discover the power of convenience with our Awesome App Features. From intuitive navigation to seamless transactions, our app is designed to enhance your user experience.

Get the funds you need in record time with Advanx's lightning-fast loan application process.

Take control of your finances with Advanx's feature-rich loan app, packed with tools to meet your needs.

Advanx's user-friendly loan platform ensures easy access to financial support for everyone.

AdvanX's commitment stands firm on the pillars of Transparency, Flexibility, Simplicity, and Service, ensuring that every interaction reflects our dedication to empowering you with clear, adaptable, and user-friendly financial solutions.

Calculate EMI effortlessly with Advanx's intuitive tool, helping you plan your finances with precision and clarity.

Our EMI calculator provides precise estimates tailored to your loan amount, interest rate, and tenure, ensuring transparency and helping you make informed financial decisions.

With Advanx's EMI calculator, explore various scenarios and adjust parameters to find a repayment plan that suits your budget and goals, empowering you to manage your finances with confidence and ease.

Any individual from target segment who is employed with a partnered organization can apply for easy loans as per their need.

Loan application is submitted with all the required information in AdvanX mobile app which is forwarded to partner employer for further verification for the application credentials

AdvanX operations team gets the required documentation & confirmation from the employer of the applicant basis which loan is approved/rejected

Automated debit process to repay in installments through direct payroll debit from the monthly salary and consent based activation of NACH mandate

Loan disbursed directly to the applicants Salary Account and same account is mapped for subsequent collection

The customers in the underserved segment due to limited financial awareness face several challenges in improving their financial situation which restricts their access to credit and in absence of credible financial advice deprives them of financial freedom.

AdvanX has designed the products for its customers and extending credit responsibly basis credit assessment including the first time borrowers

Yes, to complete the application you need to download the AdvanX app from Google Play store. Bit.ly link. The app will also help you to easily monitor your loan repayment

When you make a draw down from your credit line, you can select tenors of between 3 and 9 months in 3 month increments. i.e. 3m, 6m, 9m

You must be an Indian citizen and aged between 21-55 years. Minimum job tenure of 6 months and earn a salary of Rs 10,000 or higher per month.

Salaried job specially blue collared segment workers who earn wages/salary in cash (to be verified by Employer) or through banking channel is a prospective AdvanX customer.

We are also looking at first time borrowers with no historical credit footprint

We will assign you a limit of between Rs. 5,000 and Rs. 50000. Your limit is based on our credit assessment of the amount of debt that you can comfortably service.